how much state tax is deducted from the paycheck

Estimate your federal income tax withholding. These amounts are paid by.

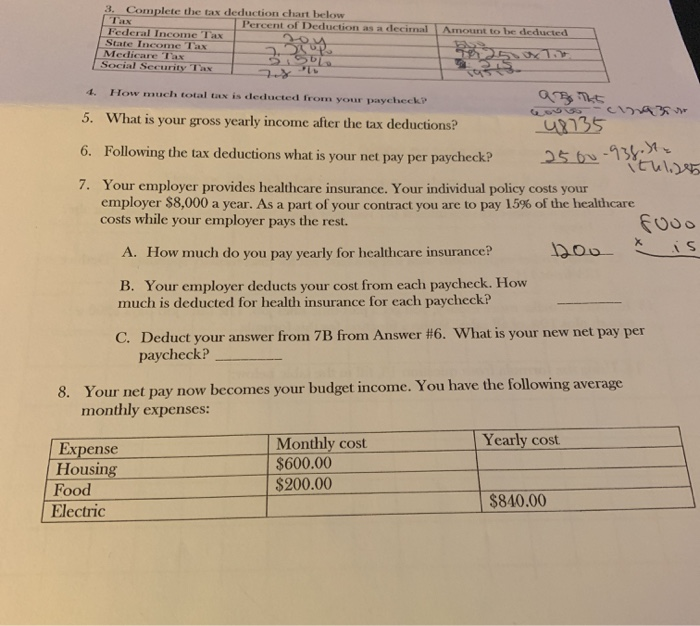

3 Complete The Tax Deduction Chart Below Percent Of Chegg Com

The refunds are not taxable as income at the state level.

. Use this tool to. If the winner opts to take the full 1 billion in winnings over 30 years they will receive annual payouts of 333 million on average before taxes. Virginia Salary Paycheck Calculator.

While the 24 federal tax. State sales tax rates in Florida are 600 percent local tax rates are 200 percent and the combined average of state and local sales taxes is 701 percent. This means the total percentage for tax deduction is 169.

Your employer pays an additional 145 the employer part of the Medicare tax. Jan 12 2021 the tax rate is 6 of the first 7000 of taxable income an employee earns annually. The amount of income tax your employer withholds from your regular pay depends on two things.

The information you give your employer on Form W-4 and DE 4 if. 252 on median income of 81868. FICA taxes consist of Social Security and Medicare taxes.

Federal income tax and FICA tax. Many states offer a. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly.

With it the worker is deducted 62 of their gross paycheck. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck. For 2022 employees will pay 62 in Social Security on the.

Calculate your Virginia net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and. In October 2020 the IRS released the tax brackets for 2021. All tax refunds including the 62F refunds are taxable at the federal level only to the extent that an individual claimed.

North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing jointly. The deduction for state and local taxes is no longer unlimited. 247 on median income of 59393.

How Your Paycheck Works. These amounts are paid by both employees and employers. See how your refund take-home pay or tax due are affected by withholding amount.

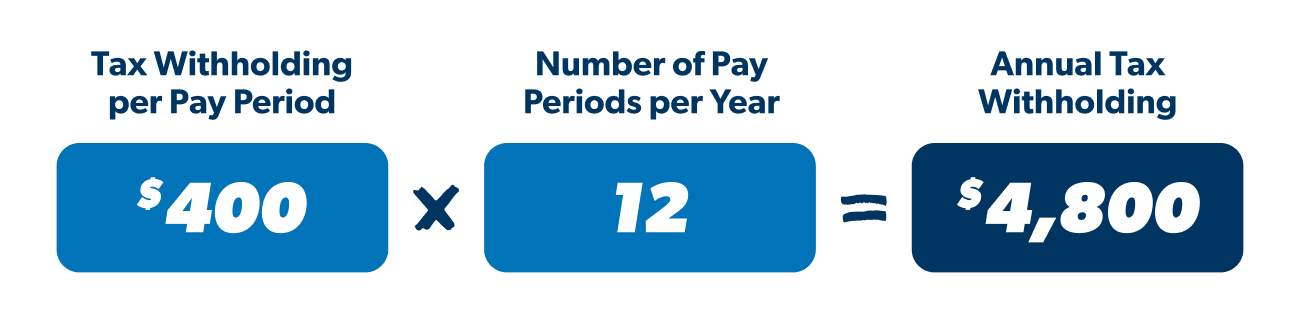

For employees withholding is the amount of federal income tax withheld from your paycheck. Some states follow the federal tax year some. Divide the sum of all assessed taxes by the employees gross pay to determine the percentage of taxes deducted from a paycheck.

At one time you could deduct as much as you paid in taxes but TCJA limits the SALT deduction to 10000 or. 249 on median income of 77378. How Is Tax Deducted From Salary.

The state tax year is also 12 months but it differs from state to state. Jan 12 2021 the tax rate is 6 of the first. The amount of income tax your employer withholds from your regular pay depends.

The result is that the FICA taxes you pay are still only 62 for Social Security and 145 for Medicare. The average marginal tax rate is 259 while the. The payer has to deduct an amount of tax based on the rules prescribed by the.

That includes overtime bonuses commissions. That is to say when workers have earned such an. Therefore the total amount of taxes paid annually would be 4403.

The mentioned tax has a limit of 147000 earned in the year. The amount you earn. There are no income limits for Medicare tax so all covered wages are subject to Medicare tax.

If you want to boost your paycheck rather than find tax-advantaged deductions from it you can seek what are called supplemental wages. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

Are Federal And State Taxes Withheld As A Percentage Of Your Pay In The Us Quora

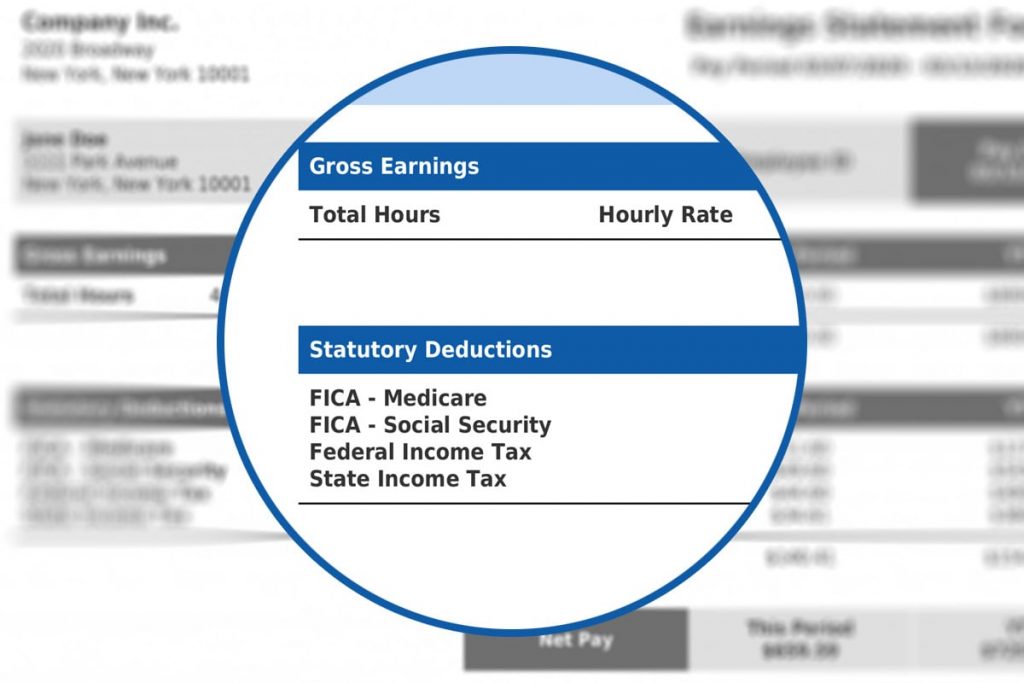

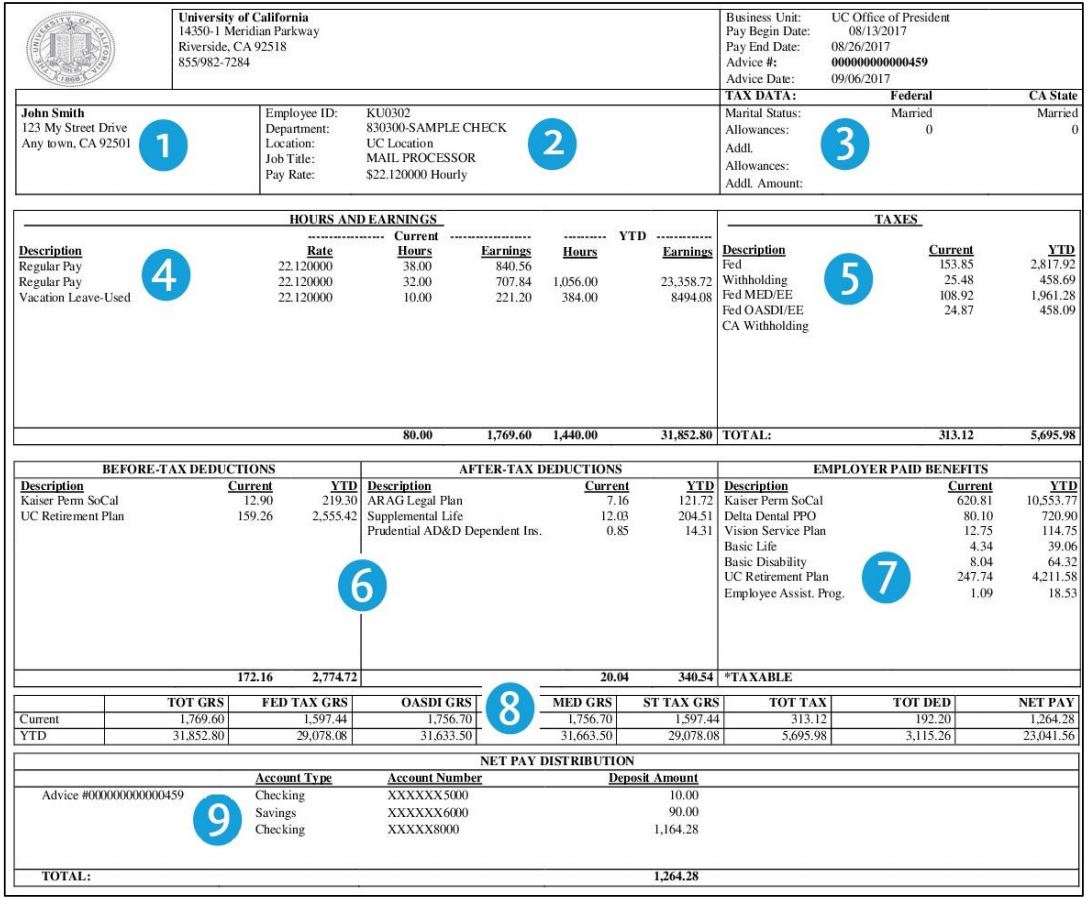

Explaining Paychecks To Your Employees

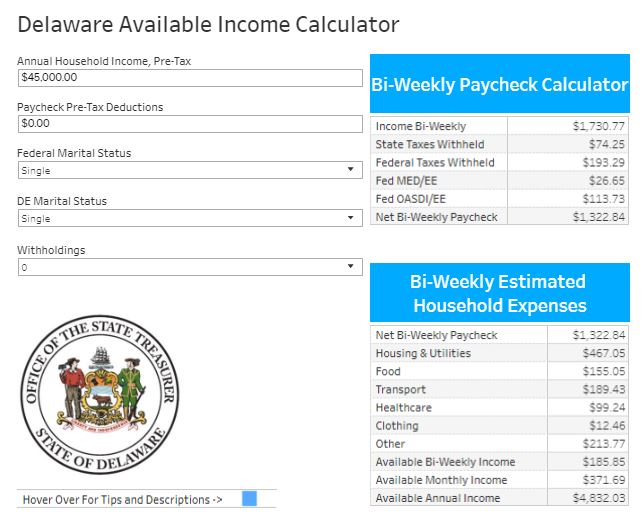

Delaware Available Income Calculator State Treasurer Colleen C Davis State Of Delaware

Paycheck Calculator Take Home Pay Calculator

Business Payroll How To Withhold Income Tax From Employee S Paychecks

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

How To Read Your Paycheck Stub Clearpoint

Decoding Your Paystub In 2022 Entertainment Partners

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

Important Tax Information Work Travel Usa Interexchange

Visualizing Taxes Deducted From Your Paycheck In Every State

What Are Pay Stub Deduction Codes Form Pros

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

How To Calculate Your Tax Withholding Ramsey

Paycheck Taxes Federal State Local Withholding H R Block

How Does The Deduction For State And Local Taxes Work Tax Policy Center

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)